"Looking for the most popular and profitable programs? Our guide highlights the top-selling programs that can help you achieve success. Explore now!"

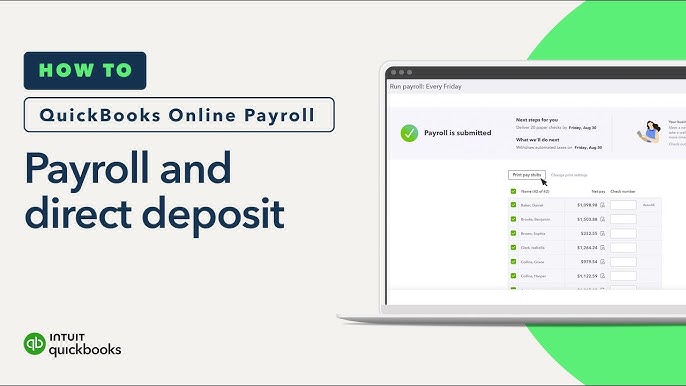

Managing payroll can be tough, but QuickBooks payroll makes it easier. It simplifies the process and cuts down on mistakes. With QuickBooks payrol-l, you can manage your payroll tasks without hassle, letting you focus on your business.

QuickBooks payroll helps you handle everything from calculating wages to filing taxes. It’s easy to use, even if you’re new to payroll. Using QuickBooks saves you time and reduces errors, helping your business grow.

QuickBooks is a complete solution for managing your payrol-l. It covers everything from processing payroll to tax compliance. By using QuickBooks payroll, you can make sure your payroll is accurate and follows all laws.

Key Takeaways

- QuickBooks payroll offers a hassle-free solution for payrol-l management

- Streamline your payrol-l processing with QuickBooks payroll

- Reduce errors and improve efficiency with QuickBooks payroll

- Easy to use and navigate, even for those with limited payroll experience

- Comprehensive solution for all your payrol-l needs, including payrol-l management and tax compliance

Understanding QuickBooks Payroll Fundamentals

Managing payroll is crucial for businesses. They need a payrol-l software that works well. QuickBooks makes payroll easier by handling employee data, taxes, and payments.

QuickBooks payroll helps businesses avoid mistakes, saves time, and follows tax laws better. It’s a big help for managing payrol-l.

QuickBooks payroll has cool features like automated tax calculations and direct deposit. It also lets employees check their pay online. This makes payrol-l management smooth and accurate.

QuickBooks has different plans for various business sizes. Here are the options:

- QuickBooks Online Payroll: great for small businesses with simple payroll needs

- QuickBooks Online Payroll Plus: good for growing businesses needing more complex payroll

- QuickBooks Online Payroll Elite: best for big businesses with advanced payroll needs

Choosing the right plan ensures businesses get the payroll solutions they need. This helps them manage payroll well.

Getting Started with Your QuickBooks Payroll Setup

To start with QuickBooks payroll, you need to know the basics. This includes how it works with your current payroll system. It helps make your payroll process smoother, cutting down on mistakes and boosting efficiency. First, you’ll set up payment schedules, figure out wages and deductions, and check and approve payments.

When you set up your payroll, remember a few important things:

- Decide on how often you’ll pay your employees

- Enter your employees’ details, like their wages, deductions, and benefits

- Make sure your system calculates taxes and deductions correctly

By following these steps and using the right payroll services, you’ll have a smooth payroll process. Payroll integration with your accounting system is key. It lets you manage all your financial data in one spot. QuickBooks makes it easy to integrate your payroll, helping you manage your finances better and follow tax laws.

Setting up QuickBooks payroll gives you access to many tools and features. These include automated tax calculations and direct deposit management. These tools save you time and cut down on errors. By using these tools and understanding payroll basics, you can create a system that fits your business needs and helps you reach your goals.

With the right payroll system, you can focus on growing your business. You’ll know your payroll is handled well and accurately. Choosing the right payroll services and setting up a strong integration can make your payroll process better, save you money, and boost productivity.

Essential QuickBooks Payroll Features for Business Success

Businesses need a solid payroll management system to keep things running smoothly. QuickBooks payroll has the tools to make this happen. It automates payroll processing, cutting down on mistakes and saving hours.

QuickBooks payroll comes with features like automated tax calculations and direct deposit management. It also lets employees check their pay online. These tools help businesses manage their payroll better, ensuring everyone gets paid on time and taxes are handled correctly.

Here are some key benefits of using QuickBooks payroll:

- Automated tax calculations to reduce errors and save time

- Direct deposit management to ensure timely payment of employees

- Employee portal access to provide employees with easy access to their payroll information

QuickBooks payroll makes payroll management easier, less prone to mistakes, and more efficient. This lets businesses focus on what they do best, not just payroll processing. It also helps keep businesses in line with tax laws, avoiding fines and penalties.

QuickBooks is a game-changer for businesses looking to improve their payrol-l management. It automates tasks, handles direct deposits, and gives employees easy access to their pay info. This way, businesses can save time, cut down on errors, and work more efficiently.

Managing Employee Information and Records

Managing employee info and records is key for any business. Payrol-l software makes this easier. It helps track hours, wages, and benefits accurately and meets legal standards.

Look for payroll services with automated time tracking, customizable reports, and secure data. These features streamline your payrol-l, cut down on mistakes, and boost efficiency.

Here are some perks of using payrol-l software for employee info and records:

- Improved accuracy and compliance

- Increased efficiency and productivity

- Enhanced security and data protection

- Customizable reporting and analytics

Investing in the right payroll solutions simplifies your payroll, saves money, and boosts employee happiness. With the right payrol services, you can focus on growing and succeeding.

In conclusion, managing employee info and records is vital for any business. The right payroll software can be a game-changer. It streamlines your payroll, boosts accuracy, and increases productivity.

| Payroll Software Features | Benefits |

|---|---|

| Automated Time Tracking | Improved Accuracy |

| Customizable Reporting | Enhanced Analytics |

| Secure Data Storage | Increased Security |

Processing Your First Payroll Run

When it comes to payroll processing, getting it right is key. You need a solid payroll system that fits your business. This means setting up payment schedules, figuring out wages and deductions, and checking and okaying payments.

A good payroll integration system makes these tasks easier. It cuts down on mistakes and saves you time. With it, you can handle tasks like tax calculations and direct deposit automatically. This lets you focus on other important business tasks.

- Set up payment schedules to ensure timely payments to your employees.

- Calculate wages and deductions accurately, taking into account taxes, benefits, and other factors.

- Review and approve payments to ensure everything is in order before processing.

By following these steps and using a strong payroll system, you can have a great first payroll run. This sets your business up for success in the long run.

| Payroll Processing Steps | Description |

|---|---|

| Set up payment schedules | Configure payment schedules to ensure timely payments |

| Calculate wages and deductions | Accurately calculate wages and deductions, including taxes and benefits |

| Review and approve payments | Review and approve payments to ensure accuracy and completeness |

Tax Compliance and Reporting Made Simple

QuickBooks payroll features make tax compliance and reporting easy. They help avoid errors and penalties. With payroll solutions like QuickBooks, businesses can create tax reports and file tax returns easily.

Tax compliance and reporting can be hard. But QuickBooks payroll services make it simpler. Some key benefits include:

- Accurate tax calculations and reporting

- Timely filing of tax returns

- Compliance with regulatory requirements

Using QuickBooks payroll features helps businesses manage tax and payroll better. It saves time and reduces errors. This lets them focus on other business areas, knowing and taxes are handled.

QuickBooks payroll solutions offer a complete way to manage payroll and taxes. They make it easier for businesses to handle payroll services and follow rules.

| Payroll Feature | Benefit |

|---|---|

| Automated Tax Calculations | Accurate and timely tax calculations |

| Direct Deposit Management | Efficient and secure payment processing |

| Employee Portal Access | Easy access to payroll information for employees |

Advanced QuickBooks Payroll Functions

For businesses with complex payroll needs, QuickBooks has advanced features. These help streamline payroll management and processing. They offer insights into payroll data, making it easier to optimize and improve payroll.

With QuickBooks payroll software, managing multi-state payroll, contractor payments, and custom reports is efficient. This helps businesses manage their payroll better.

Some key advanced features of QuickBooks include:

- Multi-state payroll processing, which makes it easy to manage payroll for employees in different states

- Contractor payments, which helps businesses manage payments to contractors and vendors efficiently

- Custom reporting tools, which give businesses detailed insights into payroll data and help them make informed decisions

Using these advanced features, businesses can improve their payroll management and processing. This reduces errors and increases efficiency. QuickBooks payroll software offers a comprehensive solution for managing payroll, allowing businesses to focus on other important tasks.

QuickBooks simplifies payroll management and processing, reducing complexity and hassle. By using QuickBooks payroll software, businesses can enhance their payroll management. This leads to cost savings and improved productivity.

Integrating Payroll with Other QuickBooks Features

Payroll integration is key to making business operations smoother. By linking payroll with QuickBooks’ accounting and time tracking, errors drop and efficiency rises. This connection gives a full view of business finances, helping in making smart decisions.

QuickBooks’ payroll system comes with many tools and services. These include automated tax calculations, direct deposit, and employee access. Using these, businesses can make payroll simpler and focus on other tasks. Services like multi-state payroll and contractor payments also work well with QuickBooks, offering a smooth experience.

- Improved accuracy and reduced errors

- Increased efficiency and productivity

- Enhanced visibility and control over business operations

- Streamlined workflows and simplified processes

Payroll integration with QuickBooks can change how businesses handle payroll. QuickBooks ensures payroll is reliable and works well with other important features.

Troubleshooting Common Payroll Challenges

Effective management is key for any business. QuickBooks helps make this process smoother. Yet, it can still face errors. Here, we’ll look at common payroll processing problems and how to fix them fast.

Issues like payment errors, tax filing troubles, and system integration problems are common. To fix these, finding the main cause and acting on it is crucial. For instance, payment mistakes might stem from wrong employee info or payment schedule mix-ups.

- Double-check employee data and payment schedules for accuracy

- Look for system updates or patches that might solve the issue

- Use QuickBooks payroll support or talk to a certified expert for help

By taking these steps and following management best practices, you can cut down on downtime. Also, make sure to regularly check and update your payroll processing system. This helps avoid errors and keeps your system running well.

Best Practices for QuickBooks Payroll Management

Managing services well is key for any business. The right payroll software can make a big difference. It’s important to follow best practices in QuickBooks payroll management. This means keeping up with the latest payroll solutions and checking payroll processes often.

Keeping your system updated is crucial for payroll security and efficiency. It helps avoid data breaches and keeps the software running well. Also, using encryption and secure storage for payroll data protects sensitive information. By using good payroll software and following best practices, businesses can lower the risk of errors and data loss.

Key Considerations for Payroll Management

- Regularly review and update processes to ensure compliance with changing regulations

- Implement robust data security measures to protect sensitive payroll information

- Use automated payroll services to streamline payroll processing and reduce errors

By following these best practices and using the right payroll software, businesses can manage their payroll services efficiently and securely. This reduces the administrative work and lets businesses focus on their main activities. With the right payroll solutions, businesses can boost their productivity and efficiency.

Mobile Access and Remote Payroll Management

Remote work has made payroll management more challenging. QuickBooks payroll features offer a solution with mobile access and remote management. This lets business owners manage payroll anywhere, reducing manual entry and boosting productivity.

Mobile access and remote payroll management bring many benefits. Business owners can process payroll anytime, anywhere. This is great for companies with many locations or remote workers. It also helps them keep up with payroll processing tasks, even when they’re not in the office.

QuickBooks mobile access and remote management include:

- Ability to process payroll from anywhere

- Access to employee data and payroll records

- Ability to approve and reject payroll transactions

- Real-time updates and notifications

Using QuickBooks features can make payroll management easier and less error-prone. This improves business efficiency and productivity. With mobile access and remote payroll management, business owners can focus on other important tasks, knowing payroll is handled.

Conclusion: Transforming Your Payroll Process with QuickBooks

QuickBooks makes managing your business’s payroll easy. It automates tax calculations and simplifies direct deposit. It also gives employees access to their information online.

QuickBooks is great for any business size. It changes how you handle employee payments and taxes. Its easy-to-use interface and detailed reports help you manage your payroll better.

Using QuickBooks can make your payroll process better. It reduces mistakes and lets you focus on growing your business. QuickBooks is a reliable choice for your payroll needs.

FAQ

What is QuickBooks Payroll and how does it work?

QuickBooks is a tool that works with QuickBooks accounting software. It makes payroll easy by automating tasks like tax calculations and employee management. This helps businesses avoid mistakes and stay in line with tax laws.

What are the core features of QuickBooks Payroll?

QuickBooks has key features like automated tax calculations and direct deposit. It also has an employee portal and reporting tools. These features help streamline payroll, improve accuracy, and offer deeper financial insights.

How do I get started with setting up QuickBooks Payroll?

Starting with QuickBooks is easy. First, connect your bank account and set up payment schedules. Then, enter your employees’ details. The software will handle the rest, making payroll management simple.

How does QuickBooks Payroll ensure tax compliance?

QuickBooks automatically handles federal, state, and local taxes. It also provides detailed tax reports. This ensures your business meets tax requirements and keeps track of tax obligations.

What are the advanced features of QuickBooks Payroll?

QuickBooks has advanced features like multi-state payroll and contractor payments. It also offers custom reporting tools. These features help businesses manage complex payroll needs and gain insights into their data.

How can I integrate QuickBooks Payroll with other QuickBooks features?

QuickBooks integrates well with other QuickBooks tools, like accounting and time tracking. This integration streamlines workflows, reduces data entry, and gives a full view of financial operations.

How can I troubleshoot common payroll challenges with QuickBooks Payroll?

QuickBooks offers support for common payroll issues. It provides tools and guidance to quickly solve problems like payment errors and tax filing issues. This ensures smooth payroll operations.

What are the best practices for managing QuickBooks ?

To manage QuickBooks well, keep the software updated and secure your data. Also, have good backup procedures. These steps protect your payroll data and prevent errors.

Can I manage payroll remotely with QuickBooks ?

Yes, QuickBooks allows remote payroll management. You can access it from anywhere, making it easier to manage payroll tasks on the go. This boosts productivity and flexibility.

Exciting offer!🎁🎁🎁🎁🎁

"Looking for the most popular and profitable programs? Our guide highlights the top-selling programs that can help you achieve success. Explore now!"